Stories that

drive change

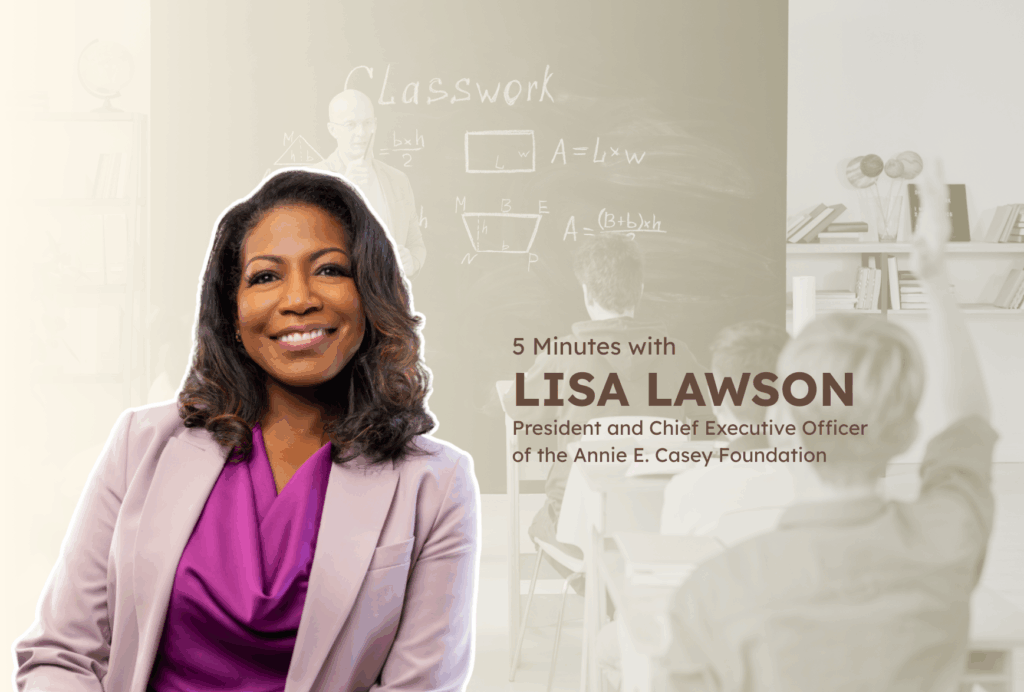

Featured Series

Our Impact Next series profiles the investors, executives, authors, philanthropists, and social sector leaders who are shaping business as a force for good.